Ever felt the urge to just *poof* a bank account out of existence? Maybe it's overflowing with dormant digital dust bunnies, or perhaps you're consolidating your financial life. Whatever the reason, closing a bank account isn't as simple as muttering a magic word. It requires a formal declaration of your intentions: the bank account closure letter. This seemingly simple document can be surprisingly complex, so let's unpack it.

Terminating a bank account isn't just about hitting delete. It's a process, a ritual, a final farewell to a financial relationship. And like any formal parting of ways, it requires the proper paperwork. A bank account closure letter, sometimes referred to as a bank a/c close letter, is your official notice to the bank, signaling your desire to sever ties with a particular account.

While the history of banking account closure letters might be less glamorous than, say, the invention of money itself, it's a vital part of the financial ecosystem. Imagine a world without this formal process – chaos! Unclaimed funds, zombie accounts, and a general administrative nightmare. The closure letter ensures a clear, documented trail, protecting both the bank and the account holder.

One of the key reasons a formal account termination request is necessary is to prevent fraud. Without a proper bank account closure document, accounts could be manipulated without the account holder’s knowledge. The written request provides a critical layer of security.

Beyond security, a properly written account closure request ensures a smooth transition. This allows for the return of any remaining funds and prevents any potential issues with future banking activities. So, while it might seem like a small piece of paper, the bank account closure letter is a powerful document.

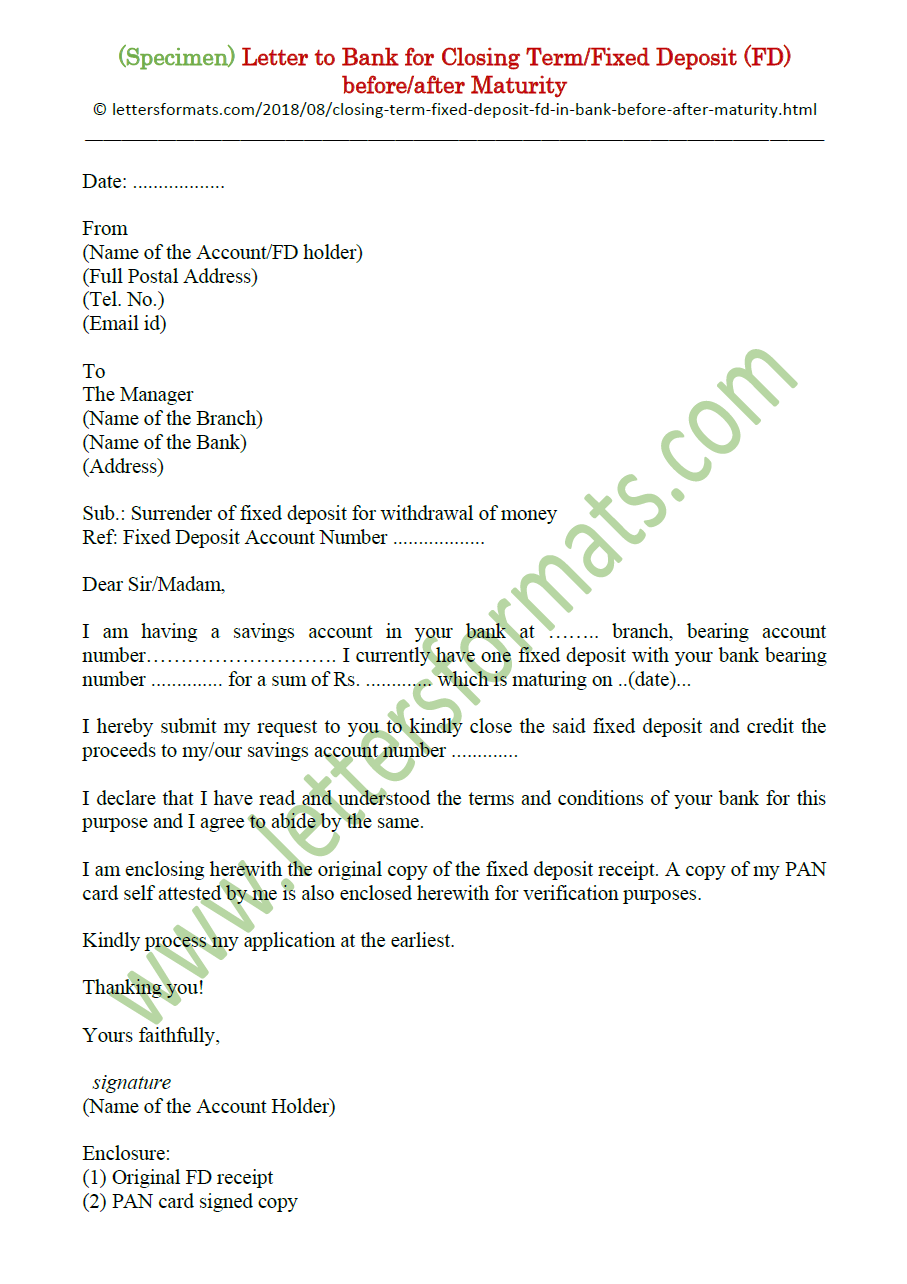

A bank account termination request is simply a letter addressed to your bank, explicitly stating your intention to close a specific account. It should include vital information such as the account number, account type (checking, savings, etc.), your full name as it appears on the account, and your current contact information. You might also include instructions for disbursing any remaining funds, like a transfer to another account or a cashier's check.

One benefit of initiating account closure is the avoidance of fees. Many banks charge fees for inactive or low-balance accounts. Closing unnecessary accounts can prevent these unwanted charges. Another benefit is simplified financial management. Fewer accounts mean less to track, making it easier to stay organized and on top of your finances.

To close a bank account, first gather all necessary information (account number, contact details). Next, draft your letter, ensuring it includes all required elements. Then, deliver the letter to your bank, either in person or via mail. Finally, confirm the closure with the bank after a reasonable period.

Checklist for Closing a Bank Account:

Verify account balance. Transfer remaining funds. Confirm automatic payments and deposits are redirected. Draft your bank a/c close letter. Deliver your letter. Confirm account closure with the bank.

Advantages and Disadvantages of Closing a Bank Account

| Advantages | Disadvantages |

|---|---|

| Avoids fees | Loss of banking history |

| Simplifies financial management | Inconvenience if account is needed |

| Reduces risk of fraud | Potential fees for early closure (some accounts) |

Best Practices: Keep a copy of your closure request. Confirm the closure in writing. Update any linked accounts. Check for outstanding transactions. Verify the return of your funds.

FAQ:

Q: What if I have automatic payments linked to the account? A: Redirect them to a different account before closing.

Q: Can I close a joint account by myself? A: Generally, both account holders need to sign the closure request.

In conclusion, the bank account closure letter, while seemingly mundane, plays a crucial role in the organized world of finance. It's a safeguard against fraud, a facilitator of smooth transitions, and a testament to the importance of clear communication in financial matters. Taking the time to understand the nuances of crafting and submitting a proper closure request can save you headaches down the road. So, the next time you're ready to bid farewell to a bank account, remember the power of this humble document. Don't just ghost your bank – give them a proper goodbye.

Unlocking the best toyota rav4 deals your guide to savings

Navigating the uncharted waters of matrimony in mafs chapter 281

Unlocking the magic of paper boats