Ever wonder what the real deal is with Medicare Plan B pricing? It's like that must-have designer bag you've been eyeing – crucial, but you need to figure out if it fits your budget. Let's unpack the complexities of Medicare Plan B costs and navigate this essential part of healthcare planning.

Understanding Medicare Plan B costs is like deciphering the fine print on a really important document. You know it's crucial, but the details can be overwhelming. So, how much does Medicare Plan B actually cost? The truth is, it's not a one-size-fits-all answer. Several factors influence the final price tag, including your income and when you enroll.

Medicare Plan B, also known as medical insurance, covers crucial services like doctor visits, outpatient care, and preventive services. Imagine it as the foundation of your healthcare safety net, catching you when unexpected medical expenses arise. But before you can rely on this safety net, you need to understand the associated costs.

The standard Medicare Part B premium is set annually. However, if your income exceeds a certain threshold, you might pay a higher premium, known as the Income Related Monthly Adjustment Amount (IRMAA). This is where things can get tricky, like trying to find the perfect vintage find in a crowded thrift store. You need to know what to look for.

Navigating Medicare Plan B pricing isn't about simply finding a number; it's about understanding the variables and planning accordingly. Think of it as curating the perfect capsule wardrobe for your healthcare needs. You want pieces (coverage) that are versatile, reliable, and within your budget.

Medicare Plan B was established in 1965 as part of the Social Security Amendments, creating a system to cover medically necessary services. Over time, the program has evolved to meet the changing healthcare needs of Americans. A key issue surrounding Plan B costs is affordability, particularly for beneficiaries with fixed or limited incomes.

Medicare Plan B premiums are typically deducted directly from your Social Security benefits. For those not receiving Social Security, Medicare sends a bill quarterly. The annual deductible is the amount you pay out-of-pocket before Medicare begins covering a percentage of your eligible medical expenses.

Benefits of having Medicare Plan B include access to essential medical services, preventive care like annual wellness visits and screenings, and coverage for medically necessary outpatient procedures. For instance, Plan B might cover your annual check-up, a specialist visit for a specific condition, or certain outpatient surgeries.

To enroll in Medicare Plan B, you can apply online through the Social Security Administration website, apply by phone, or apply in person at your local Social Security office.

Advantages and Disadvantages of Medicare Plan B

| Advantages | Disadvantages |

|---|---|

| Access to essential medical services | Monthly premiums |

| Preventive care coverage | Annual deductible |

| Coverage for outpatient procedures | Potential for IRMAA payments |

Best practices for managing Medicare Plan B costs include: understanding the IRMAA income thresholds, reviewing your coverage annually during the Open Enrollment Period, exploring options for financial assistance programs if eligible, and keeping accurate records of your medical expenses.

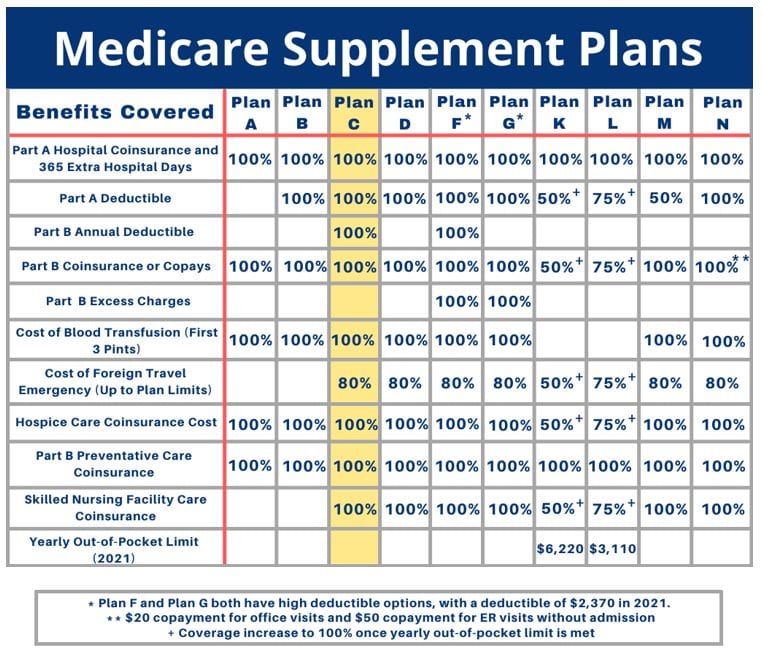

Common challenges related to Medicare Plan B costs include unexpected medical expenses and managing the deductible. Solutions can include supplemental insurance (Medigap) policies, Medicare Advantage plans, and prescription drug plans (Part D) to help manage overall healthcare costs.

Frequently asked questions about Medicare Plan B costs often revolve around premium amounts, the deductible, IRMAA calculations, and payment options. You can find answers to these questions on the Medicare.gov website.

A valuable tip for managing Plan B costs is to budget for the monthly premium and anticipate the annual deductible. Understanding these costs allows you to plan for healthcare expenses and avoid financial surprises.

In conclusion, understanding the intricacies of Medicare Plan B pricing is like mastering the art of a perfectly curated outfit. It requires careful consideration, research, and a willingness to adapt to changing trends (or healthcare needs). By grasping the factors influencing Plan B costs, you can confidently navigate the healthcare landscape and ensure you have the coverage you need. This guide has provided a comprehensive overview of Medicare Plan B costs, including premiums, deductibles, and how they fit into your overall healthcare budget. Take the time to explore the resources available, ask questions, and plan accordingly. Your future self will thank you for it. Don’t just accept the complexities of Medicare Plan B costs; decode them, embrace them, and make them work for you.

Decoding anglo saxon appellations unearthing the magic of old english female names

Unlock your dream home with sherwin williams colors

Decoding electrical blueprints understanding socket and switch symbols