Are you feeling overwhelmed by the complexities of Medicare? You're not alone. Millions of Americans turn to supplemental insurance to help manage the costs associated with original Medicare. AARP, a trusted advocate for seniors, offers a range of Medicare supplement plans, often referred to as Medigap, designed to fill the gaps in your original Medicare coverage. This article will guide you through the essentials of AARP Medicare supplement insurance, equipping you with the knowledge to make informed decisions about your healthcare.

Medicare supplement insurance offered through AARP can significantly impact your healthcare expenses and peace of mind. These plans, provided by UnitedHealthcare, help cover costs that original Medicare doesn't, such as copayments, coinsurance, and deductibles. Understanding the nuances of these plans is crucial for maximizing your benefits and minimizing out-of-pocket costs. Let's delve deeper into the world of AARP Medicare secondary coverage.

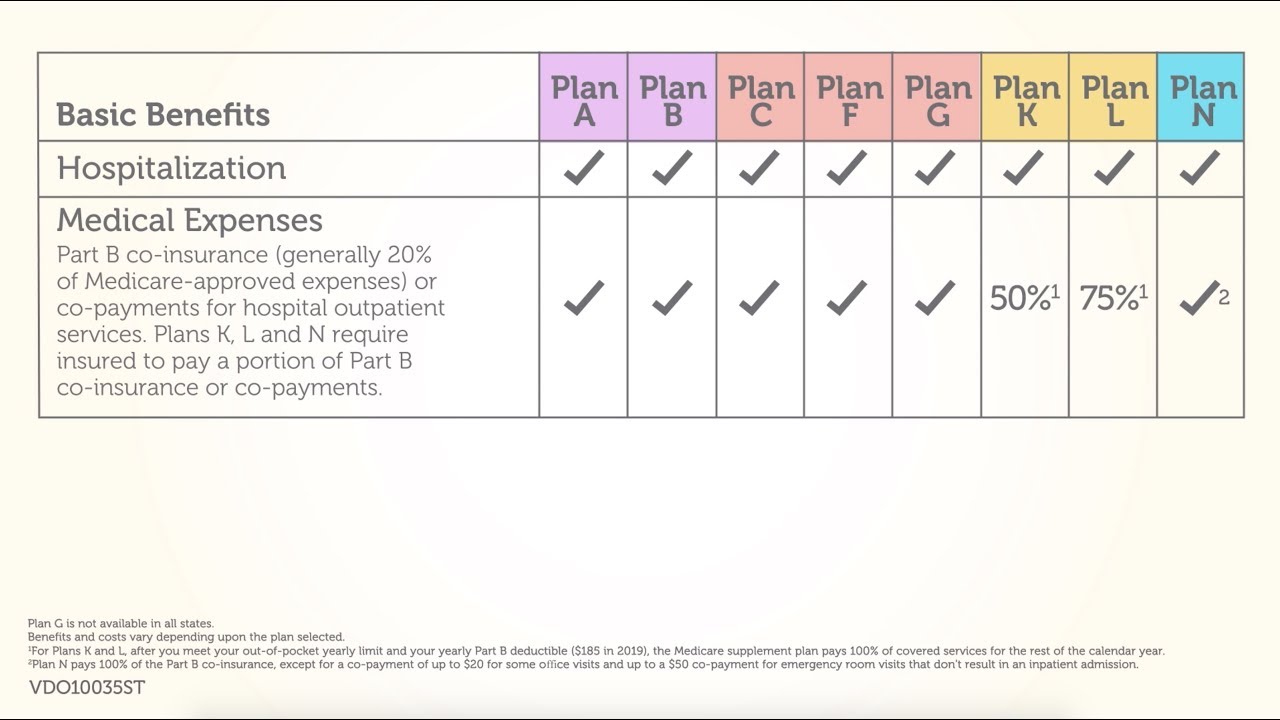

AARP doesn't directly offer Medicare supplement plans; rather, they endorse plans provided by UnitedHealthcare. This partnership leverages the reputation and resources of both organizations to offer comprehensive supplemental coverage options for seniors. The plans are standardized, meaning that Plan G, for example, offers the same benefits regardless of where you live, though premiums can vary. Choosing the right plan depends on your individual healthcare needs and budget.

One of the primary concerns for those approaching Medicare eligibility is managing healthcare expenses. AARP Medigap plans are designed to address this concern by providing financial protection against the often unpredictable costs associated with medical care. By covering expenses like coinsurance and copayments, these plans help create a more predictable healthcare budget and offer peace of mind knowing you're protected against unexpected medical bills. This predictability allows for better financial planning and can alleviate stress related to healthcare expenses.

Understanding the history of Medigap plans can shed light on their current role in the healthcare landscape. Medigap plans emerged to address the gaps in original Medicare coverage, providing beneficiaries with more comprehensive protection against healthcare costs. Over time, these plans have become a vital component of the healthcare system for many seniors, offering a layer of financial security and allowing individuals to access necessary medical services without the fear of overwhelming expenses. AARP's involvement in offering Medigap plans further solidifies their importance and helps ensure seniors have access to reputable and comprehensive supplemental coverage.

Navigating the different AARP Medicare supplement plans requires understanding their structure and benefits. Plan F, for example, covers most Medicare cost-sharing, while Plan N offers a different cost-sharing structure with lower premiums but some copays for doctor visits and emergency room care. Each plan has specific benefits and premium costs, so comparing options is essential to choose the best fit for your individual needs and budget. Consider your healthcare utilization patterns, anticipated medical expenses, and financial resources when selecting a plan.

Advantages and Disadvantages of AARP Medicare Supplement Plans

| Advantages | Disadvantages |

|---|---|

| Predictable healthcare costs | Monthly premiums |

| Gap coverage for Medicare expenses | May not cover all out-of-pocket costs |

| Access to a wide network of healthcare providers | Limited flexibility to change plans |

Frequently Asked Questions about AARP Medicare Supplement Plans:

1. What is the difference between Medicare Advantage and AARP Medicare supplement plans? Medicare Advantage plans are an alternative to original Medicare, while Medigap plans supplement your existing original Medicare coverage.

2. How much do AARP Medicare supplement plans cost? Premiums vary based on the plan selected, your location, and other factors.

3. When can I enroll in an AARP Medicare supplement plan? The best time to enroll is during your Medigap Open Enrollment Period.

4. Can I switch AARP Medicare supplement plans? You can switch plans, but you may be subject to underwriting and higher premiums.

5. Are there any restrictions on which doctors I can see with an AARP Medicare supplement plan? Generally, you can see any doctor who accepts Medicare.

6. What is the difference between Plan F and Plan G? Plan F covers the Part B deductible while Plan G does not.

7. How do I apply for an AARP Medicare supplement plan? You can apply through UnitedHealthcare or an independent insurance agent.

8. Can I use my AARP Medicare supplement plan when traveling? Most plans offer coverage anywhere in the United States.

One important tip is to carefully compare plans and consider your individual healthcare needs and budget. Work with a licensed insurance agent who specializes in Medicare to understand your options.

In conclusion, navigating the complexities of Medicare can be challenging, but AARP Medicare supplement insurance offers valuable support and financial protection. Understanding the nuances of these plans, from their history and origins to their various benefits and associated costs, empowers you to make informed decisions about your healthcare. By carefully considering your needs and researching the available options, you can choose an AARP Medicare supplement plan that provides peace of mind and helps you manage the financial aspects of healthcare, allowing you to focus on your well-being. Don't hesitate to reach out to UnitedHealthcare or a licensed insurance agent for personalized guidance. Take the time to thoroughly evaluate your options – your future health and financial security are worth it.

Ea fc 24 mods enhance your game

Finding serenity with warm white gray paint

Decoding medicare deductibles bcbs plan f coverage