In today's data-driven world, harnessing the power of spreadsheets is essential for financial success. Imagine having a dynamic tool at your fingertips, capable of crunching numbers, generating reports, and providing invaluable insights into your business's financial health. This is the power of an accounting spreadsheet, specifically in the ubiquitous platform of Microsoft Excel. Whether you're a seasoned accountant or a small business owner, understanding how to leverage Excel for accounting can revolutionize your financial management.

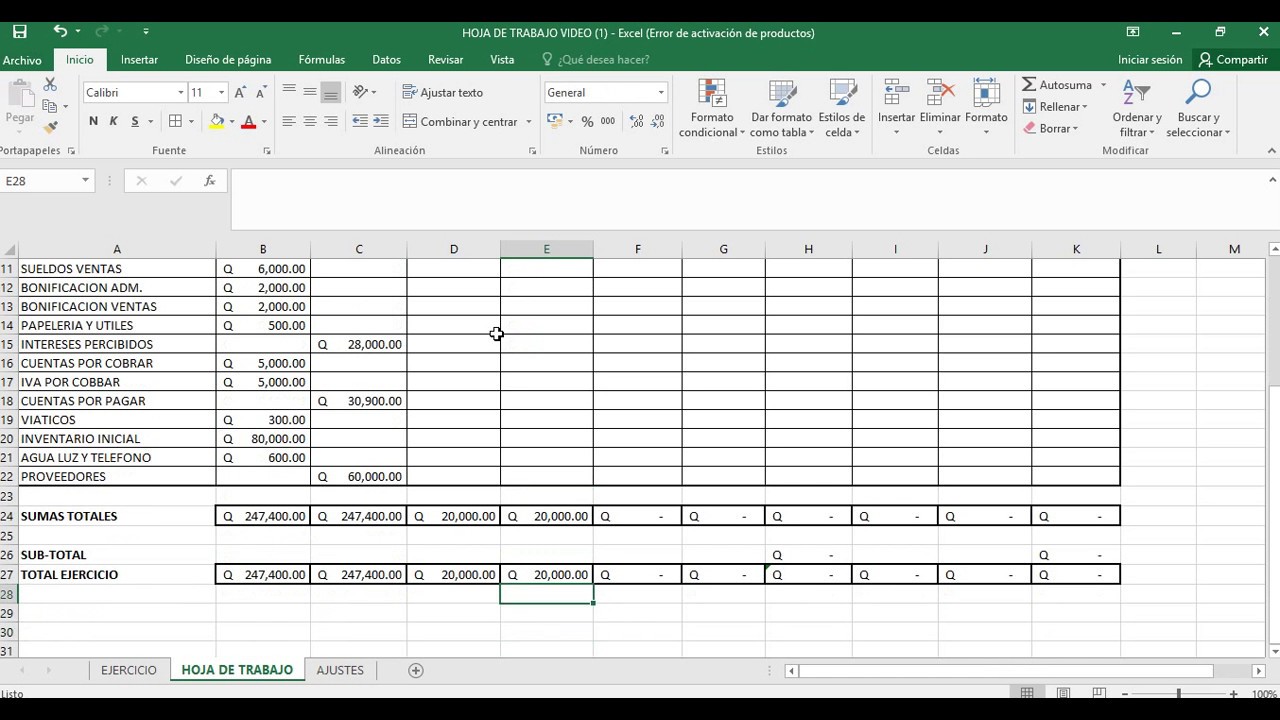

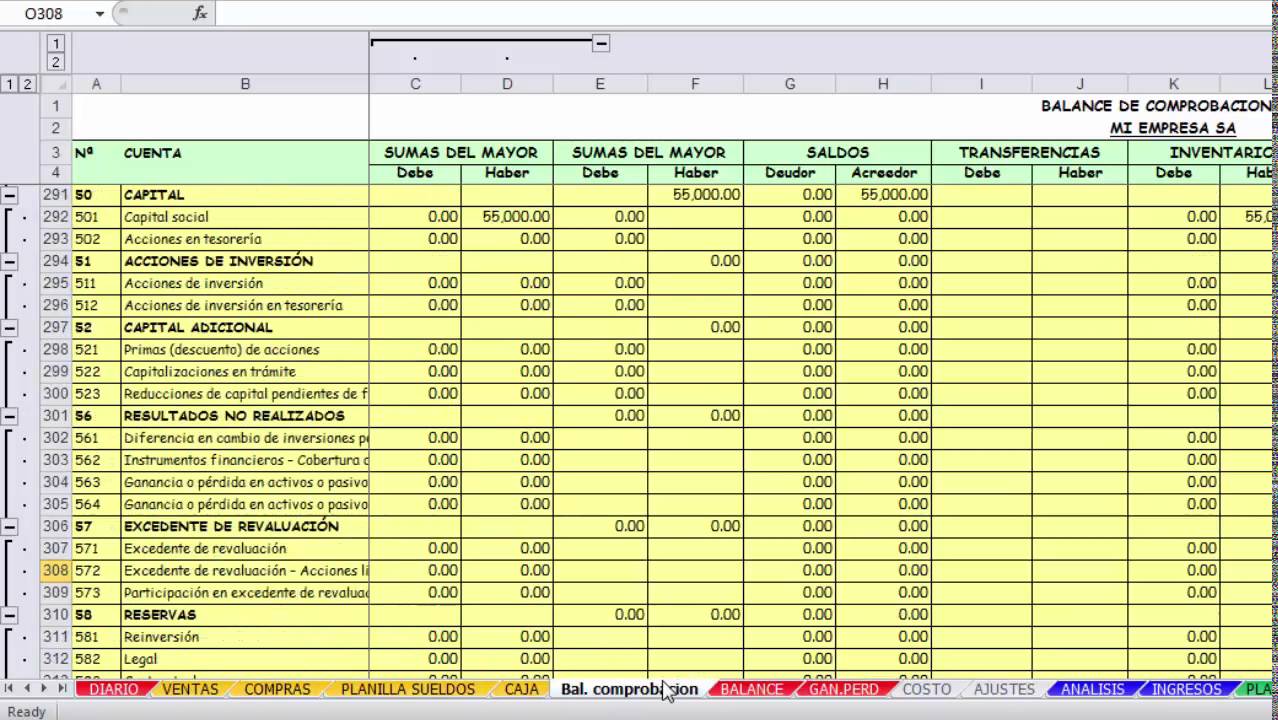

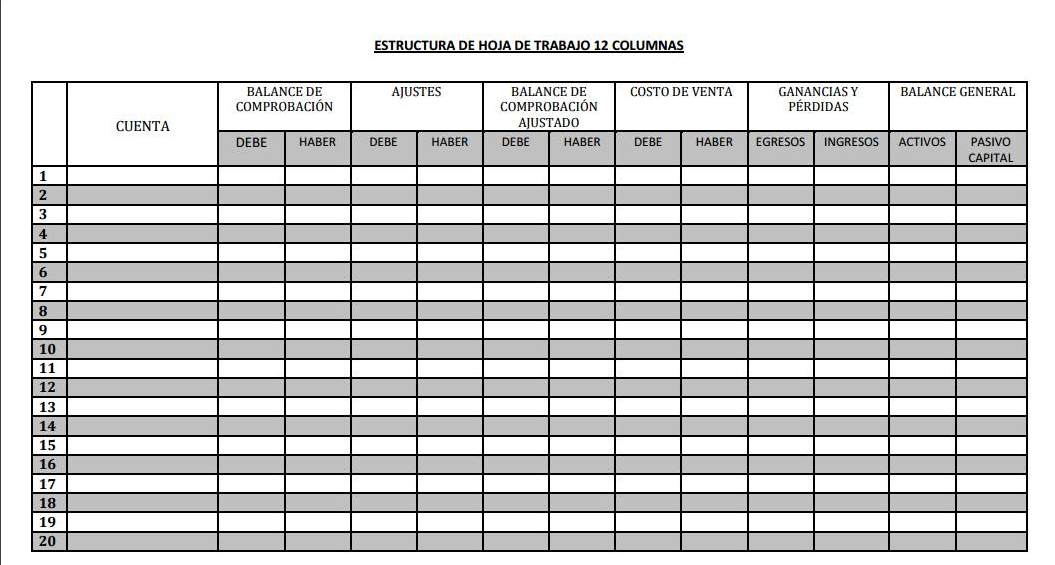

An "ejemplo hoja de trabajo contabilidad excel," or example accounting worksheet in Excel, provides a structured framework for organizing and analyzing financial data. These digital ledgers can range from simple templates tracking income and expenses to complex models forecasting future performance. They are the digital equivalent of traditional paper ledgers, offering the flexibility and power of automated calculations, formula-driven analysis, and visual representations of data through charts and graphs.

The use of spreadsheets for accounting tasks has evolved alongside the development of personal computers and software. Initially, dedicated accounting software was expensive and complex. Spreadsheets provided a more accessible and adaptable alternative. As Excel became the industry standard, its features grew to accommodate increasingly sophisticated accounting needs. Today, Excel remains a crucial tool, even with the rise of cloud-based accounting software, offering a customizable and readily available platform for specific tasks and deeper data manipulation.

The importance of a well-designed Excel accounting spreadsheet cannot be overstated. Accurate and organized financial data is the bedrock of informed decision-making. From tracking cash flow to managing budgets and generating financial reports, these spreadsheets provide a clear picture of a business's financial status, allowing for proactive management and strategic planning. Without a robust system for managing financial data, businesses risk inaccuracies, inefficiencies, and missed opportunities.

However, using Excel for accounting also presents challenges. Manual data entry can be time-consuming and prone to errors. Complex formulas require careful implementation and testing. Data security and version control can also be concerns, especially in collaborative environments. Addressing these challenges is key to maximizing the benefits of Excel for accounting.

A basic example of an Excel accounting worksheet could be a simple income statement. This would involve listing revenue sources in one column and expenses in another. Formulas can then be used to calculate gross profit, net profit, and other key metrics. More complex examples might include balance sheets, cash flow statements, or inventory management systems.

One key benefit of using Excel for accounting is its flexibility. Users can customize spreadsheets to meet their specific needs, creating templates for various tasks and tailoring reports to specific audiences. Another benefit is its accessibility. Excel is widely available and relatively easy to learn, making it a practical tool for businesses of all sizes.

A third key benefit is the power of automation. Formulas and macros can automate repetitive tasks, saving time and reducing the risk of errors. This automation can free up valuable time for analysis and strategic planning, allowing businesses to focus on growth and profitability.

Advantages and Disadvantages of Excel for Accounting

| Advantages | Disadvantages |

|---|---|

| Flexibility and Customization | Prone to Errors with Manual Entry |

| Accessibility and Affordability | Data Security and Version Control Challenges |

| Automation Capabilities | Limited Collaboration Features Compared to Cloud-Based Solutions |

Effective implementation requires careful planning and execution. Start by identifying your specific accounting needs and defining the scope of your spreadsheet. Then, design the layout and structure of the spreadsheet, ensuring clear labeling and logical organization. Next, implement formulas and functions for automated calculations. Thoroughly test the spreadsheet to ensure accuracy and reliability. Finally, document the spreadsheet to ensure maintainability and ease of use for others.

In conclusion, leveraging the power of Excel for accounting offers significant advantages for businesses of all sizes. From basic budgeting to complex financial modeling, Excel provides a versatile and accessible platform for managing financial data. While challenges exist, careful planning, implementation, and adherence to best practices can mitigate these risks. By embracing the power of Excel, businesses can gain valuable insights into their financial performance, enabling informed decision-making and driving sustainable growth.

The allure of a black chevy malibu finding your perfect ride

Navigating the uncharted waters of married at first sight chapter 3600

Winning nfl bets unlocking the secrets of expert picks

/CuentasT-597ba12a3df78cbb7a258566.png)